Is your business ready for the new credit card chip…and does it need to be?

Is your current payment processor or other solicitors telling you new machines that read these new cards are REQUIRED at your office or you will be non-compliant or face fines?

The EMV chip card “requirement” is not actually a requirement?

There is no extra fee that will be charged to process payments if you do not have a chip reader/EMV machine…period!

So, why all the hype? And, what is EMV then?

The hype…mostly…it’s just another way the unregulated credit card processing industry has found to make money off of unsuspecting business owners.

WARNING…THIS SECTION IS A BIT TECHNICAL…

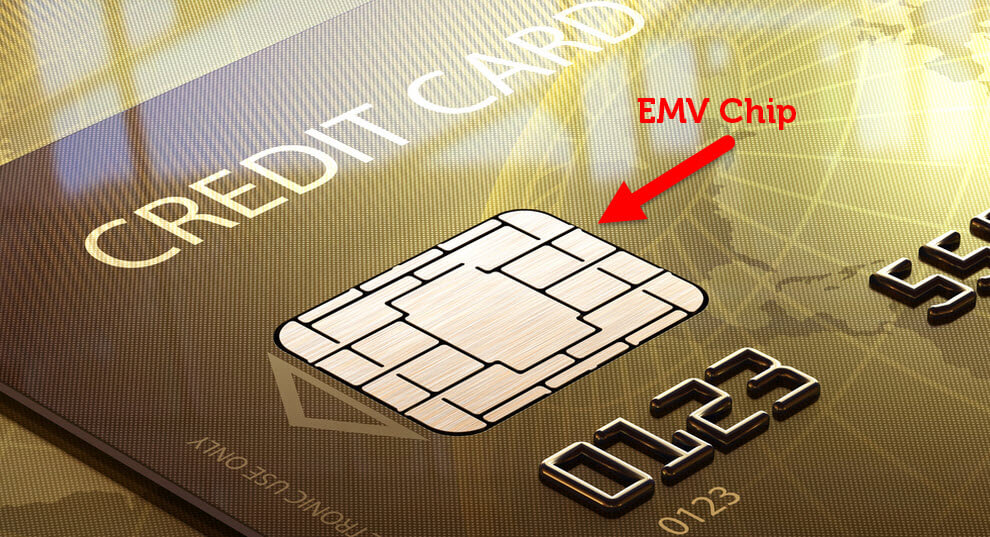

EMV stands for Europay, MasterCard and Visa, a global standard for inter-operation of integrated circuit cards (IC cards or “chip cards”) and IC card capable point of sale (POS) terminals and automated teller machines (ATMs), for authenticating credit and debit card transactions.

An EMV machine will offer protection against disputes related to the acceptance of fraudulent credit cards. If you do not have an EMV machine, and the customer provides a card with a chip on it, and that transaction is later found to be fraudulent, then there is no protection against that dispute.

So…how do you “protect” your organization then?

As usual, your best protection is to verify the card holder by verifying the ID. If you have a new client, simply ask them for their ID to verify they are who they say they are.

DON’T BE TRICKED INTO BUYING NEW EQUIPMENT OR SIGNING NEW LONG-TERM CONTRACTS.